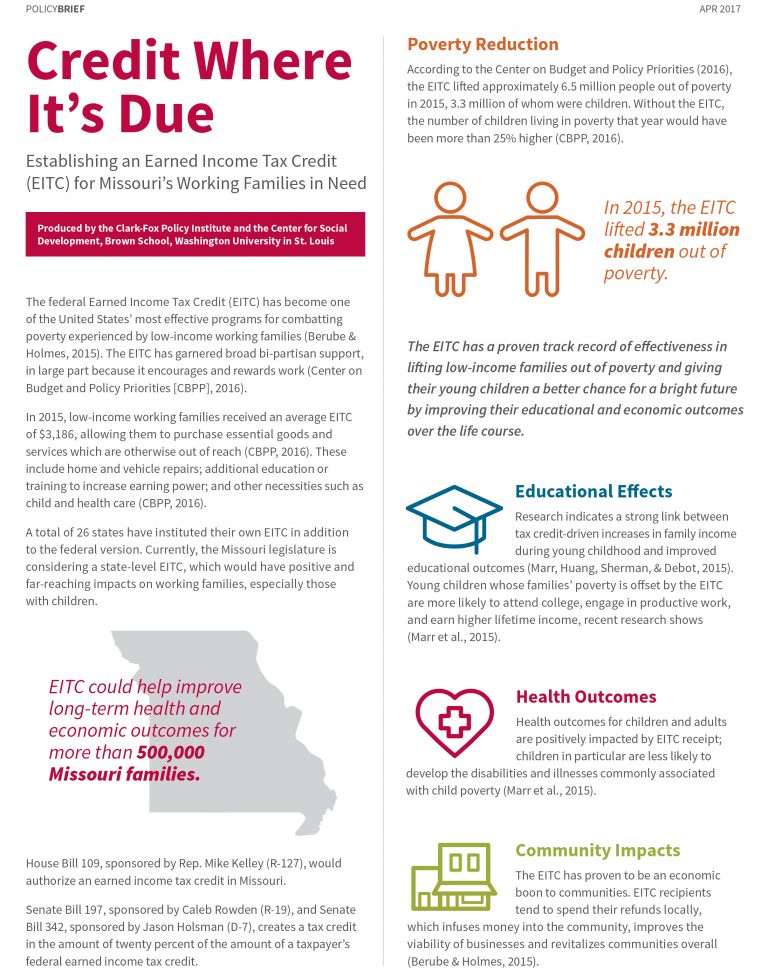

The Missouri government is considering legislation that would create a state-level Earned Income Tax Credit (EITC). The EITC is a refundable tax credit that benefits low- to moderate-income working individuals and couples, particularly those with children. The EITC has a proven track record of effectiveness in lifting low-income families out of poverty and improving educational and economic outcomes over the life course.

The Clark-Fox Policy Institute’s first policy brief looks at a Missouri Earned Income Tax Credit, which could help improve health and economic outcomes for more than 500,000 Missouri families. Click the image below to download the brief. Track bills here: HB 109; SB 197; and SB 342.